The Ultimate Guide To What Is A 1031 Exchange California

Table of ContentsThe Buzz on 1031 Exchange Into A FundEverything about 1031 Exchange Into A FundSome Of 1031 Exchange RulesThe Best Guide To 1031 Exchange RulesThe Best Strategy To Use For 1031 Exchange Rules California

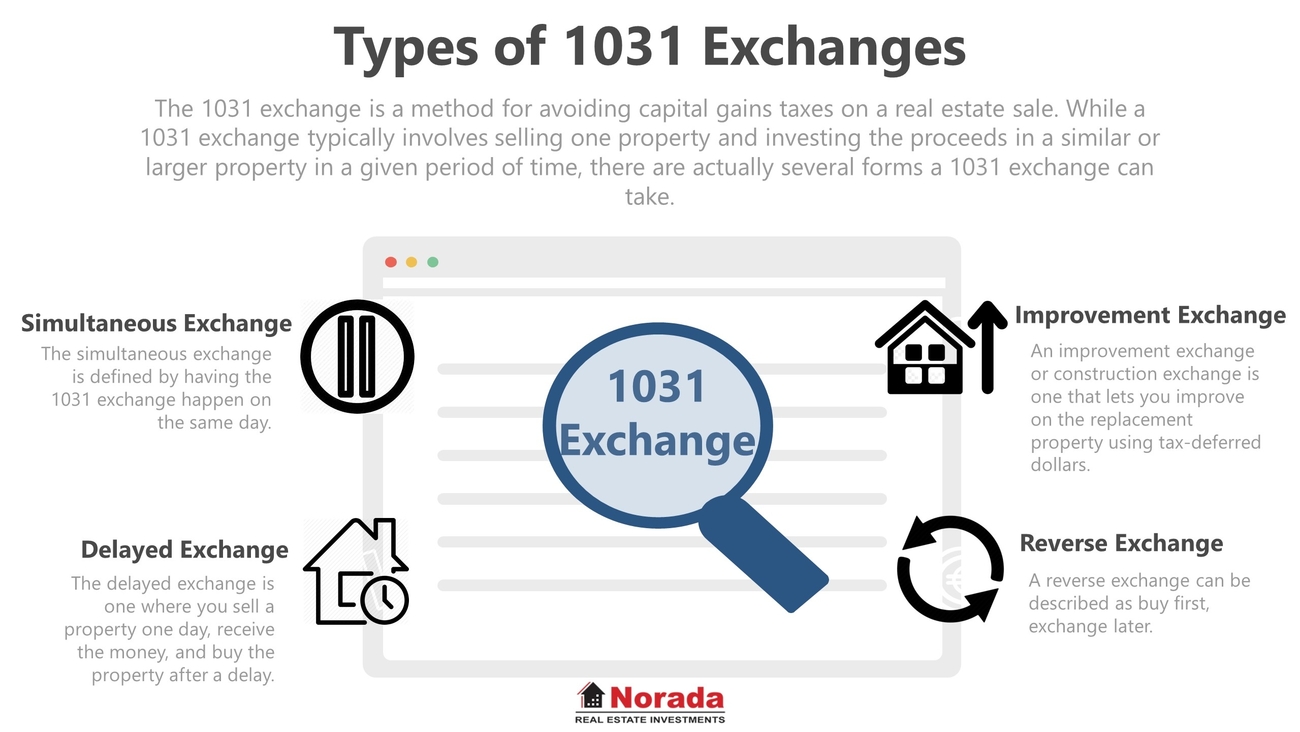

In actual estate, a 1031 exchange is a swap of one financial investment property for another that permits resources gains taxes to be delayed. The termwhich obtains its name from Internal Income Code (IRC) Section 1031is bandied about by property agents, title firms, investors, as well as football mommies. Some individuals even demand making it into a verb, as in, "Let's 1031 that structure for one more." IRC Area 1031 has several relocating components that property capitalists must comprehend prior to attempting its use. Trick Takeaways A 1031 exchange is a swap of buildings that are held for business or investment objectives. The buildings being exchanged must be taken into consideration like-kind in the eyes of the Internal Revenue Service (IRS) for resources gains tax obligations to be deferred.The regulations can use to a previous main residence under extremely details problems. What Is Section 1031? The majority of swaps are taxable as sales, although if yours satisfies the requirements of 1031, then you'll either have no tax or minimal tax due at the time of the exchange.

That enables your investment to remain to grow tax deferred. There's no limitation on just how regularly you can do a 1031. You can roll over the gain from one item of investment realty to an additional, and also another, as well as one more. Although you may have a revenue on each swap, you avoid paying tax obligation until you offer for cash numerous years later.

The smart Trick of Real Estate Investment Companies In California That Nobody is Talking About

To certify, a lot of exchanges should merely be of like-kindan enigmatic expression that doesn't indicate what you believe it indicates (here). You can exchange a home structure for raw land, or a ranch for a shopping center. The policies are surprisingly liberal. You can even exchange one organization for another. There are catches for the unwary.

There are additionally methods that you can use 1031 for swapping vacation homesmore on that particular laterbut this technicality is much narrower than it utilized to be. To get a 1031 exchange, both residential properties should be found in the United States. Special Policies for Depreciable Residential property Unique guidelines use when a depreciable building is exchanged.

In general, if you exchange one building for one more building, you can prevent this recapture. Such difficulties are why you need professional aid when you're doing a 1031.

6 Simple Techniques For 1031 Exchange Real Estate

Currently, only actual building (or property) as defined in Section 1031 qualifies. It deserves noting, nonetheless, that the TCJA complete expensing allocation for particular substantial individual property might assist to make up for this modification to tax law. The TCJA consists of a change policy that allowed a 1031 exchange of qualified personal effects in 2018 if the original building was marketed or the substitute residential property was gotten by Dec.

The change guideline is details to the taxpayer and did not permit a reverse 1031 exchange where the brand-new property was bought prior to the old residential or commercial property is marketed. Exchanges of company supply or collaboration interests never ever did qualifyand still do n'tbut interests as a occupant alike (TIC) in realty still do.

Excitement About 1031 Exchange Fund

The probabilities of discovering somebody with the specific residential or commercial property that you desire who desires the precise building that you have are slim. Therefore, most of exchanges are postponed, three-party, or Starker exchanges (named for the very first tax obligation situation that allowed them). In a postponed exchange, you require a certified intermediary (intermediary), that holds the cash after you "market" your home and utilizes it to "get" the replacement building for you.

The IRS claims you can assign three residential properties as long as you ultimately close on one of them. You can even mark greater than 3 if they fall within specific valuation examinations. 180-Day Rule The second timing guideline in a postponed exchange associates with closing. You need to close on the brand-new residential or commercial property within 180 days of the sale of the old home.

Tax Shelter Real Estate - An Overview

1031 Exchange Tax Obligation Effects: Cash and Financial debt You might have money left over after the intermediary gets the substitute building. If so, the intermediary will certainly pay it to you at the end of the 180 days. click here now. That cashknown as bootwill be strained as partial sales proceeds from the sale of your home, generally as a funding gain.

If read this you do not obtain cash money back yet your obligation goes down, then that additionally will certainly be dealt with as income to you, simply like cash. Expect you had a home loan of $1 million on the old building, but your home mortgage on the brand-new residential property that you receive in exchange is just $900,000.